GDPR Debate

GDPR Debate

On Monday, 16th October, Data Compliant’s Victoria Tuffill was invited by AccountancyWeb to join a panel discussion on how GDPR will impact accountants and tax agents.

The other members of the panel were our host, John Stokdyk, Global Editor of AccountingWEB, who kept us all on the straight and narrow, while asking some very pertinent questions; Ian Cooper from Thomson Reuters who gave strong insights into technical solutions; and Dave Tucker from Thompson Jenner LLP, who provided a very useful practitioner viewpoint.

GDPR in General

There is a presumption that every professional body is fully informed of all compliance regulations within their field of expertise. But the continuing barrage of changes and adjustments to European and British law makes it easy to drop the ball.

GDPR is a typical example. To quote the Information Commissioner, Elizabeth Denham, it’s “The biggest change to data protection law for a generation”. Yet for many accountants – and so many others – it’s only just appearing on the radar. This means there’s an increasingly limited amount of time to be ready.

GDPR has been 20 years coming, and is intended to bring the law up to date – in terms of new technology, new ways we communicate with each other, and the increasing press coverage and consumer awareness of personal data and how it’s used by professional organisations and others. GDPR has been law for 17 months now, and it will be enforced from May 2018.

GDPR and Accountants

So what does GDPR mean for accountants in particular?

- Accountants will have to deal with the fact that it’s designed to give individuals back their own control over their own personal information and strengthens their rights.

- It increases compliance and record keeping obligations on accountants. GDPR makes it very plain that any firm which processes personal data is obliged to protect that data – for accountants that responsibility is very significant given the nature of the personal data an accountant holds.

- There are increased enforcement powers – I’m sure everyone’s heard of the maximum fine of E20,000 or 4% of global turnover, whichever is higher. But also, the media have a strong hold on the whole area of data breaches – and often the reputational damage has a far greater impact than the fine.

- Accountancy firms must know precisely what data they hold and where it’s held so they can they assess the scale of the issue, and be sure to comply with the demands of GDPR.

The video covers key points for practitioners to understand before they can prepare for compliance, and summarises some initial steps they should take today to prepare their firms.

The other members of the panel were our host, John Stokdyk, Global Editor of AccountingWEB, who kept us all on the straight and narrow, while asking some very pertinent questions; Ian Cooper from Thomson Reuters who gave strong insights into technical solutions; and Dave Tucker from Thompson Jenner LLP, who provided a very useful practitioner viewpoint.

The session can be found here: Practice Excellence Live 2017: GDPR.

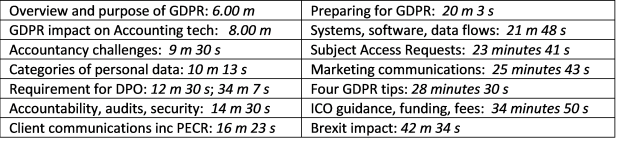

It is a 45 minute video, so for those with limited time, I have broken down the areas covered into bite-size chunks:

Data Compliant is working with its clients to help them prepare for GDPR, so if you are concerned about how GDPR will affect your firm or business, feel free to give us a call and have a chat on 01787 277742 or email dc@datacompliant.co.uk if you’d like more information.

Data Compliant is working with its clients to help them prepare for GDPR, so if you are concerned about how GDPR will affect your firm or business, feel free to give us a call and have a chat on 01787 277742 or email dc@datacompliant.co.uk if you’d like more information.

Victoria Tuffill 19th October, 2017