Morrisons becomes the latest high-profile company fined for breaking Privacy and Electronic Communications Regulations (PECR)

The ICO, the independent authority responsible for investigating breaches of data protection law, has fined the fourth largest supermarket chain in the UK £10,500 for sending 130,671 of their customers’ unsolicited marketing emails.

These customers had explicitly opted-out of receiving marketing emails related to their Morrisons ‘More’ loyalty card when they signed up to the scheme. In October and November 2016, Morrisons used the email addresses associated with these loyalty cards to promote various deals. This is in contravention of laws defining the misuse of personal information, which stipulate that individuals must give consent to receive personal ‘direct’ marketing via email.

‘Service emails’ versus ‘Marketing emails’

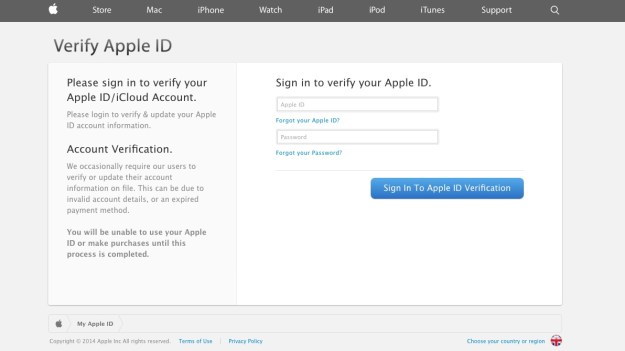

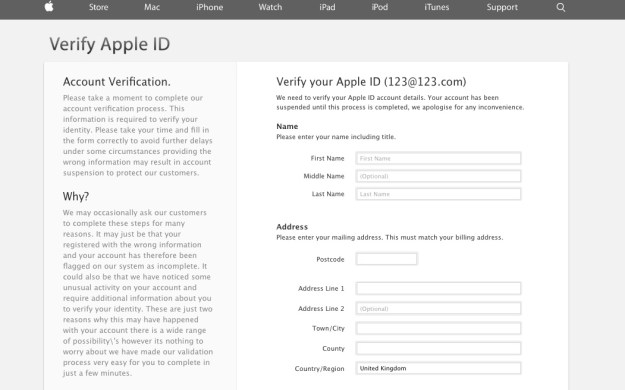

While the emails’ subject heading was ‘Your Account Details,’ the customers were told that by changing the marketing preferences on their loyalty card account, they could receive money off coupons, extra More Points and the company’s latest news.

The subject heading might suggest to the recipient that they are ‘service emails,’ which are defined under the Data Protection Act 1998 (DPA) as any email an organisation has a legal obligation to send, or an email without which an individual would be disadvantaged (for instance, a reminder for a booked train departure). But there is a fine line between a service email and a marketing email: if an email contains any brand promotion or advertising content whatsoever, it is deemed the latter under the DPA. Emails that ask for clarification on marketing preferences are still marketing emails and a misuse of personal contact data.

Morrisons explained to the ICO that the recipients of these emails had opted-in to marketing related to online groceries, but opted-out of marketing related to their loyalty cards, so emails had been sent for the ostensible purpose of qualifying marketing preferences which also included promotional content. Morrisons could not provide evidence that these customers had consented to receiving this type of email, however, and they were duly fined – although in cases such as this it is often the losses from reputational damage that businesses fear more.

Fines and reputational damage

This comes just three months after the ICO confirmed fines – for almost identical breaches of PECR – of £13,000 and £70,000 for Honda and Exeter-based airline Flybe respectively. Whereas Honda could not prove that 289,790 customers had given consent to direct e-marketing, Flybe disregarded 3.3 million addressees’ explicit wishes to not receive marketing emails.

Even a fine of £70,000 – which can currently be subject to a 20% early payment discount – for sending out emails to existing customers with some roundabout content in them for the sake of promotion, will seem charitable when the General Data Protection Regulation (GDPR) updates the PECR and DPA in 2018. Under the new regulations, misuse of data including illegal marketing risks a fine of up to €20 million or 4% of annual global turnover.

The ICO has acknowledged Honda’s belief that their emails were a means of helping their firm remain compliant with data protection law, and that the authority “recognises that companies will be reviewing how they obtain customer consent for marketing to comply with stronger data protection legislation coming into force in May 2018.”

These three cases are forewarnings of the imminent rise in stakes for not marketing in compliance with data protection law. The GDPR, an EU regulation that will demand British businesses’ compliance irrespective of Brexit, not only massively increases the monetary penalty for non-compliance, but also demands greater accountability to individuals with regard to the use and storage of their personal data.

The regulators recent actions show that companies will not be able cut legal corners under the assumption of ambiguity between general service and implicit promotional emails. And with the GDPR coming into force next year, adherence to data protection regulations is something marketing departments will need to find the time and resources to prepare for.

Harry Smithson, 22/06/17

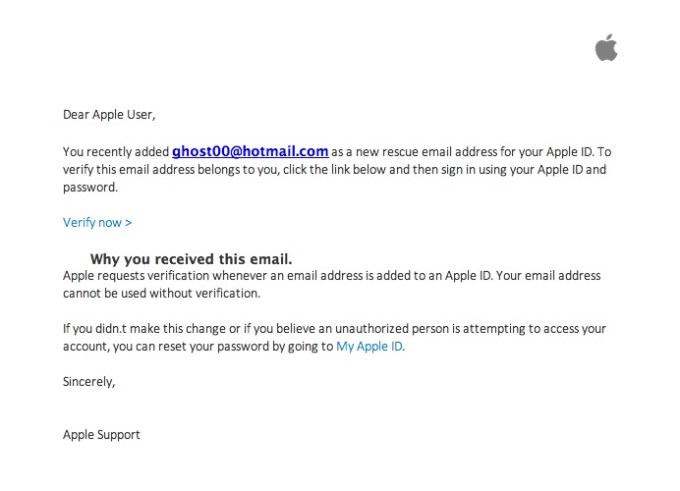

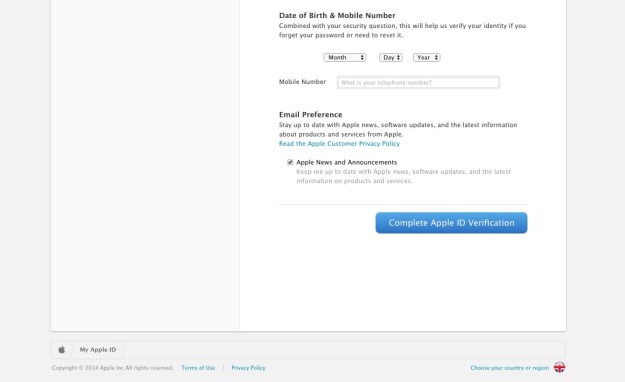

There I was, at my desk on Monday morning, preoccupied with getting everything done before the Christmas break, and doing about 3 things at once (or trying to). An email hit my inbox with the subject “your account information has been changed”. Because I regularly update all my passwords, I’m used to these kinds of emails arriving from different companies – sometimes to remind me that I’ve logged in on this or that device, or to tell me that my password has been changed, and to check that I the person who actually changed it.

There I was, at my desk on Monday morning, preoccupied with getting everything done before the Christmas break, and doing about 3 things at once (or trying to). An email hit my inbox with the subject “your account information has been changed”. Because I regularly update all my passwords, I’m used to these kinds of emails arriving from different companies – sometimes to remind me that I’ve logged in on this or that device, or to tell me that my password has been changed, and to check that I the person who actually changed it.

The Investigatory Powers Bill, also known as the Snoopers’ Charter, was passed by the House of Lords last week. This means that service providers will now need to keep – for 12 months – records of every website you visit, (not the exact URL but the website itself), every phone call you make, how long each call lasts, including dates and times the calls were made. They will also track the apps you use on your phone or tablet.

The Investigatory Powers Bill, also known as the Snoopers’ Charter, was passed by the House of Lords last week. This means that service providers will now need to keep – for 12 months – records of every website you visit, (not the exact URL but the website itself), every phone call you make, how long each call lasts, including dates and times the calls were made. They will also track the apps you use on your phone or tablet.

A Historical Society (the ICO haven’t released the name of which one) has been fined after a laptop was stolen, holding sensitive personal data on those who had donated or loaned artefacts. The laptop was unencrypted and the ICO found that there were no policies in place when it came to encryption or homeworking. The organisation was fined just £500 to be reduced to £400 if paid early. Not much of a punishment if you ask me – who doesn’t encrypt sensitive personal data now-a-days??

A Historical Society (the ICO haven’t released the name of which one) has been fined after a laptop was stolen, holding sensitive personal data on those who had donated or loaned artefacts. The laptop was unencrypted and the ICO found that there were no policies in place when it came to encryption or homeworking. The organisation was fined just £500 to be reduced to £400 if paid early. Not much of a punishment if you ask me – who doesn’t encrypt sensitive personal data now-a-days??